Asset Document

Bank Statement Analysis

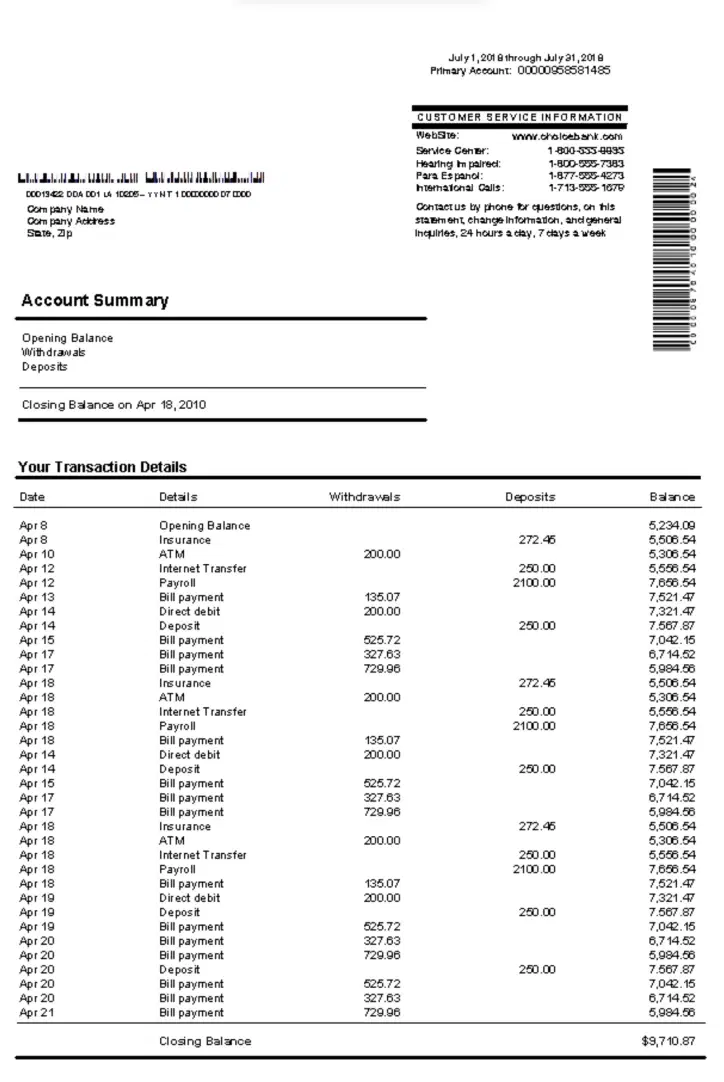

Instantly analyze a bank statement and produce accurate data using AREAL.ai’s extensive automation tools

Bank statement analysis is a crucial financial assessment tool employed by individuals, businesses, and financial institutions to evaluate financial health and track spending patterns. By scrutinizing monthly bank statements, one can gain insights into income sources, expenditures, and overall cash flow.

Stop wasting precious time manually reviewing documents

Analysts focus on transaction details, identifying trends, anomalies, and potential areas for improvement or risk. For businesses, this process aids in budgeting, forecasting, and decision-making. Personal finance management benefits from a clearer understanding of spending habits and saving potential. Additionally, lenders use bank statement analysis to assess the creditworthiness of borrowers. Overall, this analytical approach offers a comprehensive view of financial activities, facilitating informed financial planning.

What is bank statement analysis?

Bank statement analysis is a methodical examination of an individual's or business's financial transactions, utilizing their bank statements as primary data. This process involves the careful inspection of income, expenditures, and other monetary activities over a specific period. The aim is to extract meaningful insights that contribute to informed financial decision-making.

To enhance the efficiency of this analysis, various tools and software have been developed, dedicated to streamlining the process. These bank statement analysis tools provide automation, categorization, and visualization features, allowing for a more systematic and accurate assessment of financial data. Such software facilitates quicker identification of patterns, irregularities, or areas requiring attention.

Bank statement analysis is instrumental for budgeting and forecasting, helping individuals and businesses understand their cash flow dynamics. For businesses, it aids in strategic planning, enabling proactive financial management. Additionally, lenders utilize bank statement analysis to evaluate the creditworthiness of potential borrowers, ensuring a thorough assessment of their financial health.

In essence, bank statement analysis is a cornerstone in financial management, providing valuable insights into financial behaviors and serving as a foundation for prudent financial planning. The integration of dedicated tools and software further amplifies its effectiveness, making the process more accessible and efficient for users.

What is the purpose of bank statement analysis?

Bank statement analysis serves to dissect financial transactions, offering crucial insights into income, expenditures, and cash flow. The primary objective is informed financial decision-making and comprehensive understanding of one's financial health. This process aids in budgeting, forecasting, and strategic planning, benefiting both individuals and businesses. Integration of bank statement analysis software and tools enhances efficiency by automating transaction categorization and providing real-time visualization. For lenders, this analysis is instrumental in assessing the creditworthiness of applicants. In essence, the purpose is to empower users with actionable insights, facilitating prudent financial management and planning.

Importance of Bank Statements

Bank statements play a crucial role for account holders and serve multiple purposes:

- Account Monitoring: Bank statements allow account holders to monitor their financial activities and keep track of their account balances. By reviewing the statement regularly, individuals can identify unauthorized transactions, track spending patterns, and ensure the accuracy of their account records.

- Financial Management: Bank statements provide valuable information for personal financial management. They offer insights into income and expenses, helping individuals create budgets, track their saving goals, and make informed financial decisions.

- Tax Preparation: Bank statements serve as supporting documentation for tax preparation. They provide evidence of income, deductible expenses, and other financial transactions that may be required when filing tax returns.

How to analyze bank statements with AI?

Analyzing bank statements with AI involves leveraging advanced algorithms and machine learning to automate the process. AI-driven bank statement analysis tools efficiently categorize transactions, identify patterns, and detect anomalies in real-time. These tools utilize natural language processing and data analytics to extract valuable insights from vast amounts of financial data, providing a more accurate and streamlined analysis. By incorporating AI, the analysis becomes faster, more precise, and capable of adapting to evolving financial scenarios, ultimately enhancing the effectiveness of financial decision-making and planning. The use of a specialized bank statement analysis tool further optimizes the application of AI in this context.

What information do bank statement analysis results provide?

Bank statement analysis results offer a comprehensive overview of an individual's or business's financial activities. They reveal income sources, spending patterns, and cash flow dynamics. This information aids in budgeting, highlighting areas for potential savings or optimization. It also uncovers trends and anomalies, facilitating proactive financial management. For businesses, the results contribute to strategic planning and resource allocation. Lenders leverage these insights to assess creditworthiness. Overall, bank statement analysis results provide actionable data for informed decision-making, empowering users to understand and improve their financial health.

What are the advantages of doing bank statement analysis with AI?

Leveraging artificial intelligence for bank statement analysis introduces a spectrum of advantages. Firstly, AI-driven tools automate the often labor-intensive process, ensuring swift and accurate categorization of transactions. The integration of machine learning algorithms adds a layer of sophistication, enabling the identification of nuanced patterns and anomalies in financial behavior. Real-time analysis is a significant benefit, allowing for quick decision-making and adaptability to dynamic financial scenarios.

Moreover, AI enhances precision in detecting irregularities, bolstering fraud prevention measures. The technology's ability to handle large datasets is particularly advantageous, providing a comprehensive and in-depth understanding of financial health. This not only aids in identifying spending patterns but also reveals potential areas for optimization and savings.

Additionally, AI contributes to proactive financial management by uncovering trends that may not be immediately apparent through traditional analysis methods. This proactive approach is invaluable for businesses in strategic planning and resource allocation. Lenders benefit as well, as AI analysis provides a more nuanced assessment of creditworthiness, considering a broader array of financial indicators.

In essence, the advantages of employing AI for bank statement analysis lie in its efficiency, accuracy, adaptability, and capacity to unveil subtle patterns, making it a powerful ally for individuals and businesses seeking informed and proactive financial decision-making.

Automated Bank Statement Analysis with AREAL.ai

Harness the power of AREAL.ai's automation tools to analyze bank statements with speed and accuracy. Here's how AREAL.ai's technology can streamline the process:

- Data Extraction: AREAL.ai's automation tools can instantly extract relevant data from bank statements, including transaction details, balances, and account information. This eliminates the need for manual data entry and reduces the chances of errors.

- Categorization and Organization: AREAL.ai can categorize transactions based on predefined criteria, making it easier to classify income, expenses, and other financial activities. The software can also organize the extracted data into a structured format for further analysis and reporting.

- Accuracy and Efficiency: By leveraging AREAL.ai's extensive automation tools, account holders can ensure the accuracy and efficiency of their bank statement analysis. The advanced algorithms minimize errors and expedite the review process, saving valuable time and effort.

Simplify Bank Statement Analysis with AREAL.ai

Optimize your bank statement analysis by utilizing AREAL.ai's automation tools. With instant analysis, accurate data extraction, and efficient categorization, AREAL.ai simplifies the process of reviewing and understanding bank statements. Say goodbye to manual data entry and time-consuming reviews, and let AREAL.ai's technology handle the task with precision and reliability.

Streamline your bank statement analysis with advanced mortgage automation. Seamlessly integrating mortgage data into your bank statements, our platform ensures accuracy and efficiency in financial assessment. Through automated workflows, we simplify the extraction and organization of mortgage-related information, reducing errors and saving valuable time. With our mortgage automation technology, navigate bank statement analysis effortlessly and make informed financial decisions with confidence. Experience a seamless process as our innovative system handles the complexities of mortgage-related data interpretation. Trust in our expertise to optimize your bank statement analysis, empowering you to gain deeper insights into your financial landscape effortlessly.